As part of the Vistage program, TD Foundry has the benefit of access to a host of content and research, this month Roger Martin-Fagg, a Behavioural Economist, has given us insight into his UK economic forecast, which predicts a continuation of the current inflationary boom –

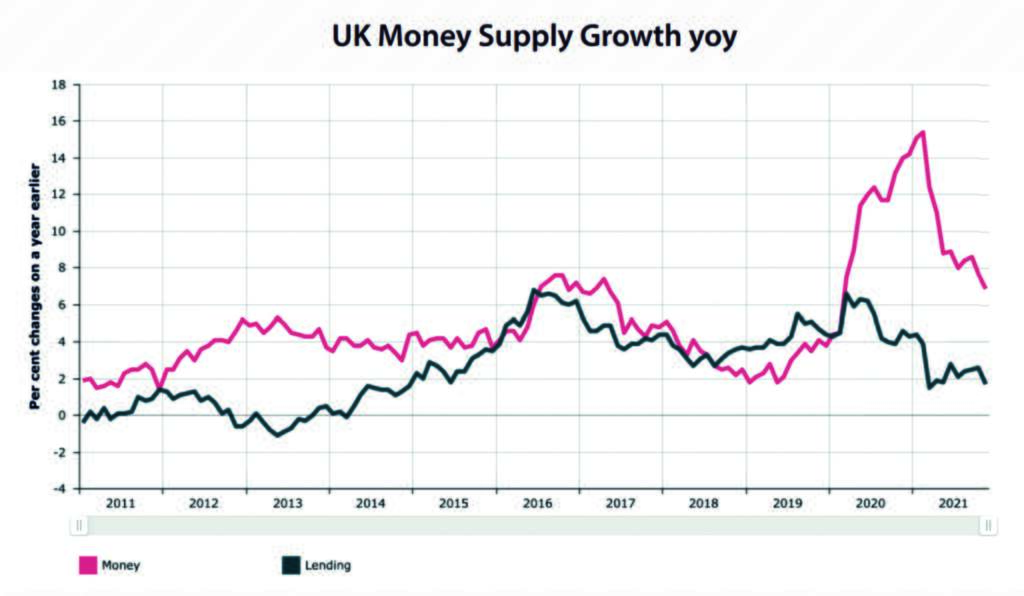

‘A look at the UK in detail – The Bank of England moves interest rates to deliver a growth in the red line of around 4-5% per month. This is enough to finance up to 3% real growth and 2% inflation. There is a time lag between changes in the interest rate and the change in money supply. So the MPC try and guess inflation two years out. If their guess is inflation will rise, they raise rates, then slowly the growth in bank lending (which is the black line) reduces and in simple terms there is less spending in the economy, making businesses reluctant to raise prices, pay higher wages or increase volume.

It is not possible to reduce inflation without reducing growth. Governments tried to do this using price and wage controls in the seventies. It doesn’t work. The recession of 1979-82 was the result of much higher than expected interest rates as the Thatcher government tried to reduce inflation. It eventually succeeded but at a cost of 3 million job losses.

To reiterate, the current growth in money supply is not because commercial banks are creating too much of it, rather it is QE money creation by the BoE. This stopped last month so as I write this the red line should be running at around 2%.

If this is the case then there is no reason to raise interest rates unless the committee believes house price inflation is excessive.

The issue for the committee is this: there is every chance there will be a wage-price spiral as employers compete for scarce labour. We are short of three million people.

To stop this, a sharp slow-down or even a recession is required. This can be achieved by getting the red line down to near zero and an interest rate of at least 3%.

What will the committee do? They will wait and see and hope increasing inflation erodes purchasing power and business optimism thereby reducing the number of vacancies.

Any increase in interest rates this year will not dampen the housing market. Only 20% of mortgages are floating and the majority of the holders have considerable cash reserves. The BoE is also set to ease mortgage lending rules. In addition, there is a flood of US money looking for buy to let assets, as well as Lloyds Bank.

The global outlook Global trade was up nearly 6% in 2021, this year we can expect 5%. Consumer demand is strong in the main regions and will remain so. China is still suffering from city lockdowns which limit supply.

Conclusions

Thanks to excess money, the wealth of owners of equities and houses has risen by 10% in the rich countries. This is reducing the supply of labour as it enables early retirement. Additionally, the collapse of the birth rate in 2000 has created a shortage of youngsters.

Excess money in the world is $17tn. This is chasing scarce resources, hence we have a global boom with inflation.

Small increases in interest rates this year will make little difference to demand. Significant increases in energy prices will be financed by accumulated savings enjoyed by 80% of the population. The other 20% will suffer, some badly.

The inflation rate will moderate in 2022 because QE will have ended everywhere and the purchasing power of existing money will have been eroded.

The inflationary boom will continue this year and into next.’*

*Source – Vistage Economic Update January 2022 – Roger Martin-Fagg, Behavioural Economist and Vistage Speaker